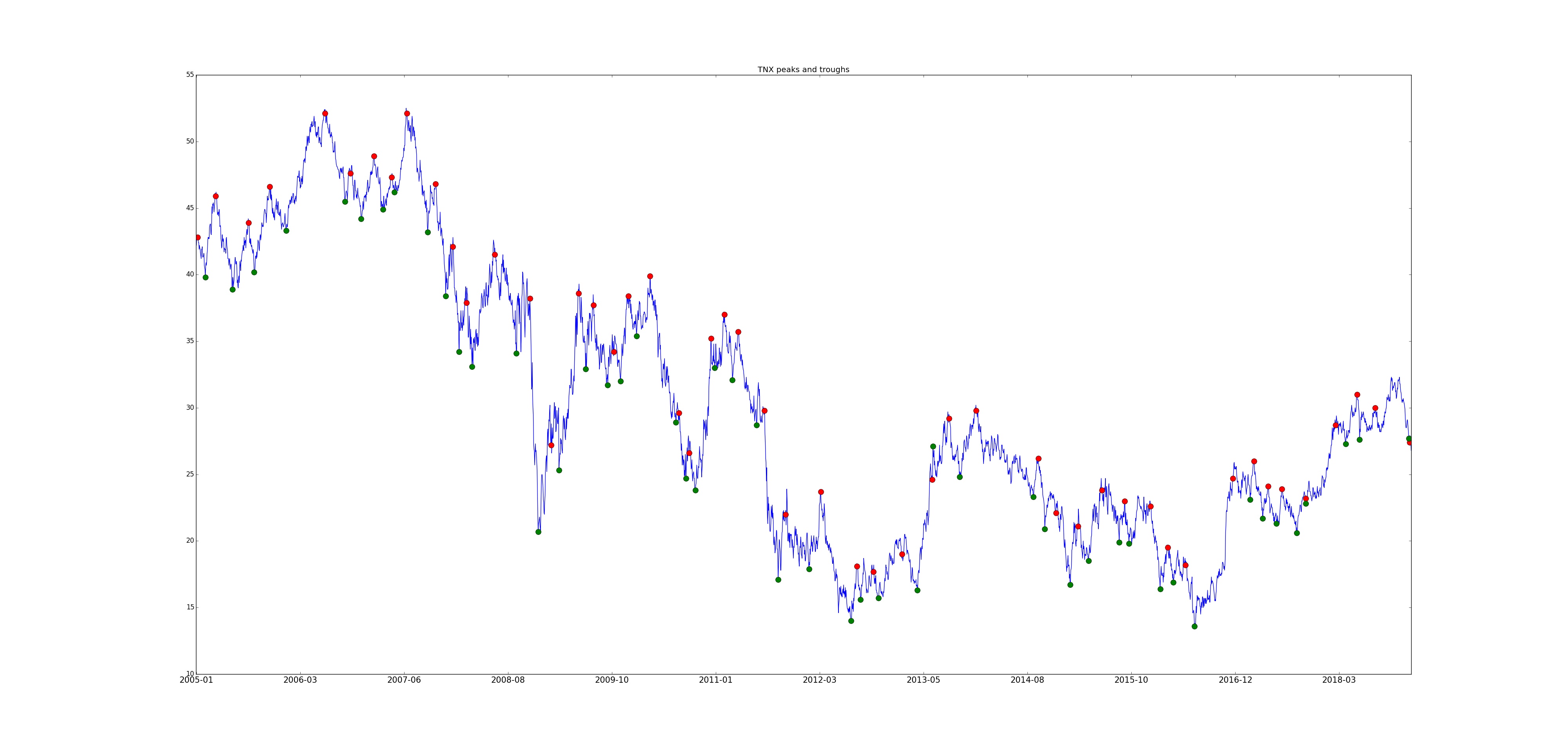

Long-term interest-sensitive assets: pair-trading REITs/ banks

REITs and banks are assets which are thought to be sensitive to interest rates. Concerns about REIT stocks emerge every once in a while when interest rates are expected to rise. We explore how sensitive, in fact, are REITs and banks to the long-term interest rates, as reflected in the 10-year treasure rate (TNX).

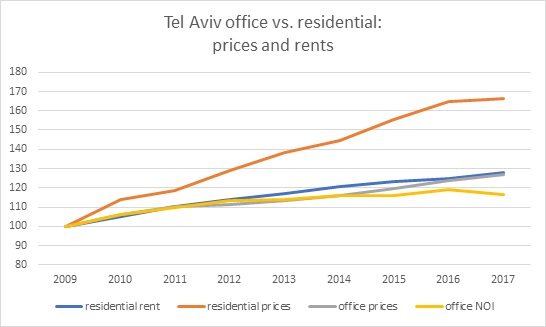

TA offices vs. residential

A comparison of prices and rents in the Tel Aviv office market vs. the Israeli residential real estate prices and rents. For the office market we use B-BRE’s data, for the residential market we use Central Bureau of Statistics data.

Tel Aviv Office Indicators 2017

Main indicators for the Tel Aviv office market, based on listed CRE companies financial reports as of 31/12/2017.

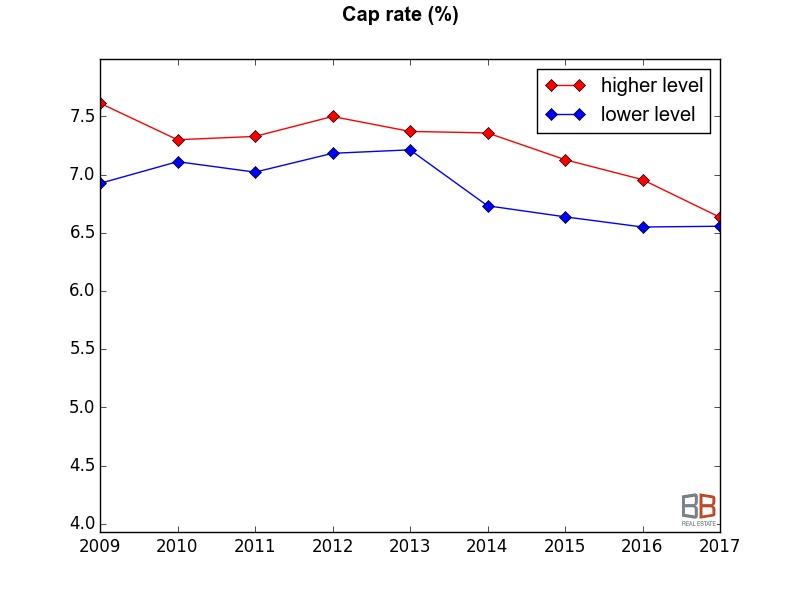

משרדים בתל אביב מדדים נבחרים

מדדים נבחרים של משרדים בת”א, בהתאם לרמת הנכסים (רמה גבוהה, רמה נמוכה). המדדים המוצגים הם שכ”ד למ”ר, תשואה, שווי הוגן למ”ר, NOI למ”ר, ותפוסה בשנים 2009-2016.

Residential Index goes live on Solactive’s website

Our new residential index tracks the residential real estate sector in Europe and the US, through the companies whose main activity is the leasing of residential properties.

IBI Investment House launches an index fund on our smart-beta US REIT index

IBI investment house launches a tracking index fund on our smart-beta US REIT index.

IBI Investment House launches an index fund on our Israel CRE index

IBI Investment House launches a tracking index fund on our first index, which is the also the first index tracking the Israeli CRE market.

B-BRE contributes to Urban Land Institute’s “City of the Year” project

B-BRE contributes to Urban Land Institute’s “City of the Year” project.

The Israeli CRE market

Main indicators for the Israeli commercial real estate market , based on the financial reports of listed real estate companies.

Tel Aviv Office Market 2009-2011

A survey of the Tel Aviv office market, based on the data of listed real estate companies. We survey vacancies, rents, prices, cap rates, and future supply.