Long-term interest-sensitive assets: pair-trading REITs/ banks

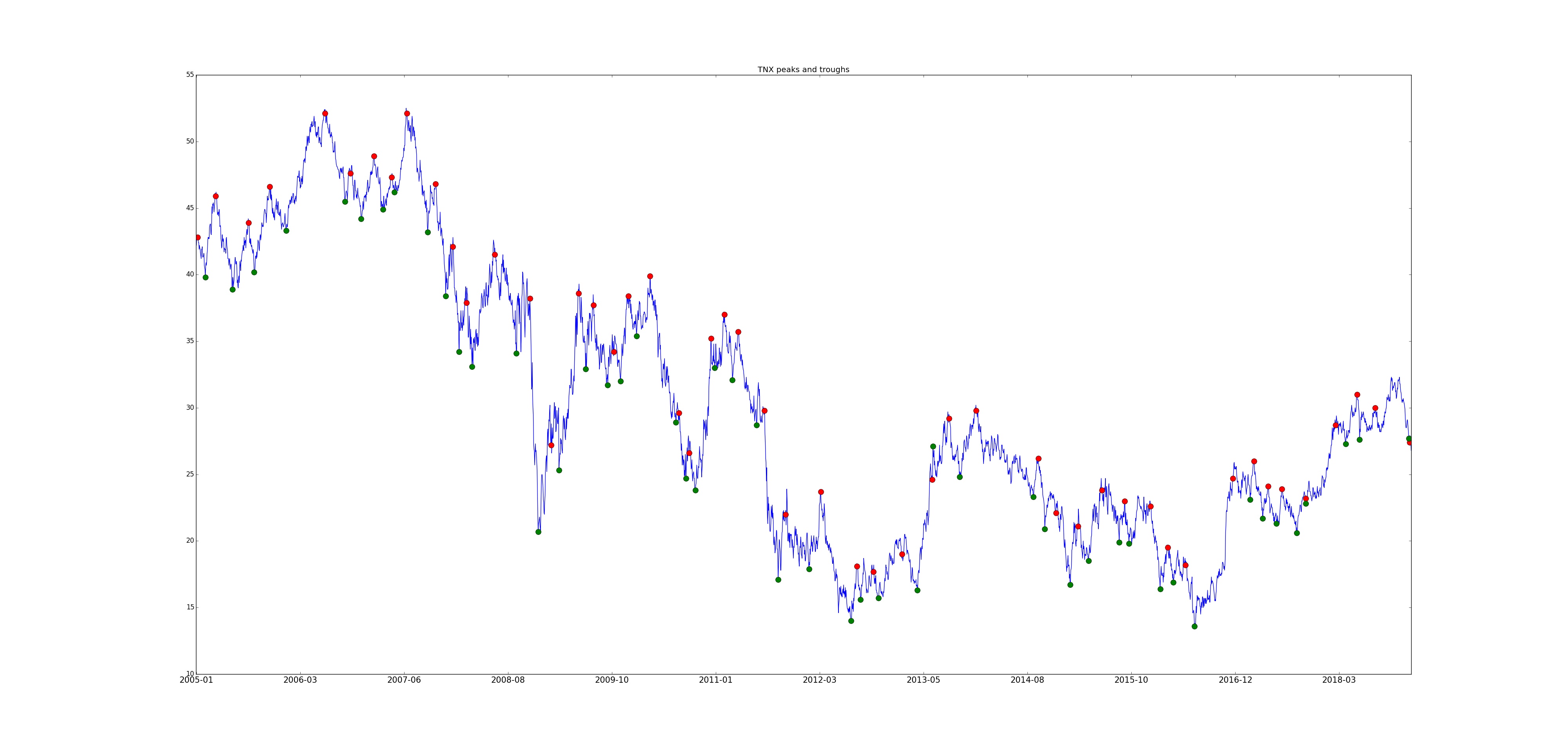

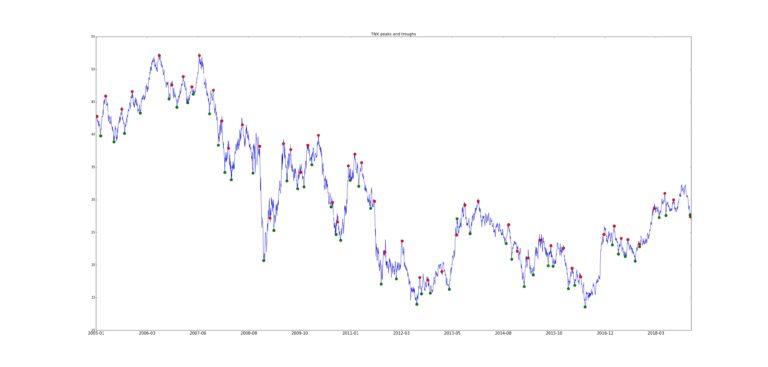

REITs and banks are assets which are thought to be sensitive to interest rates. Concerns about REIT stocks emerge every once in a while when interest rates are expected to rise. We explore how sensitive, in fact, are REITs and banks to the long-term interest rates, as reflected in the 10-year treasure rate (TNX).